Vertaling en analyse van woorden door kunstmatige intelligentie ChatGPT

Op deze pagina kunt u een gedetailleerde analyse krijgen van een woord of zin, geproduceerd met behulp van de beste kunstmatige intelligentietechnologie tot nu toe:

- hoe het woord wordt gebruikt

- gebruiksfrequentie

- het wordt vaker gebruikt in mondelinge of schriftelijke toespraken

- opties voor woordvertaling

- Gebruiksvoorbeelden (meerdere zinnen met vertaling)

- etymologie

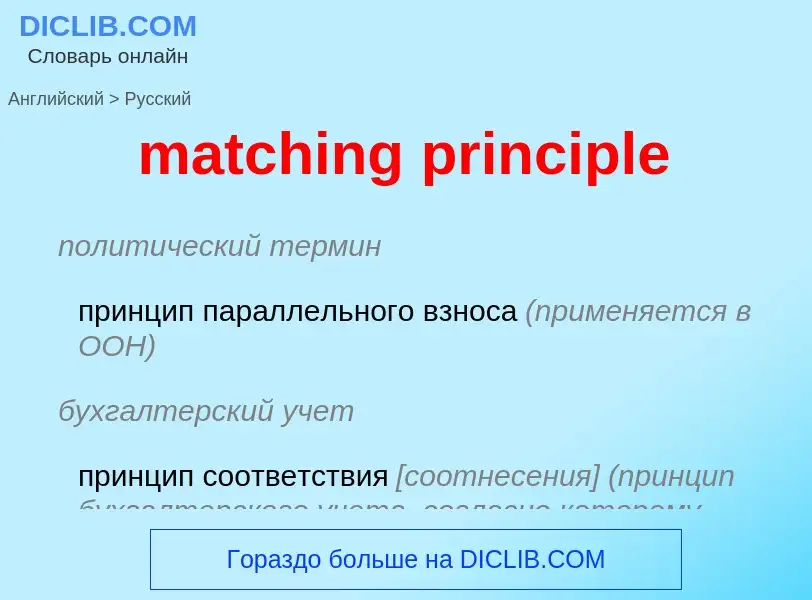

matching principle - vertaling naar Engels

политический термин

принцип параллельного взноса (применяется в ООН)

бухгалтерский учет

принцип cоответствия [соотнесения] (принцип бухгалтерского учета, согласно которому доходы сопоставляются с расходами, которые понесены для получения этих доходов; т. е. все расходы, связанные с доходами периода, должны быть отражены в отчетности за тот же период)

синоним

Definitie

Wikipedia

In accrual accounting, the matching principle instructs that an expense should be reported in the same period in which the corresponding revenue is earned, and is associated with accrual accounting and the revenue recognition principle states that revenues should be recorded during the period in which they are earned, regardless of when the transfer of cash occurs. By recognizing costs in the period they are incurred, a business can see how much money was spent to generate revenue, reducing "noise" from timing mismatch between when costs are incurred and when revenue is realized. Conversely, cash basis accounting calls for the recognition of an expense when the cash is paid, regardless of when the expense was actually incurred.

If no cause-and-effect relationship exists (e.g., a sale is impossible), costs are recognized as expenses in the accounting period they expired: i.e., when have been used up or consumed (e.g., of spoiled, dated, or substandard goods, or not demanded services). Prepaid expenses are not recognized as expenses, but as assets until one of the qualifying conditions is met resulting in a recognition as expenses. Lastly, if no connection with revenues can be established, costs are recognized immediately as expenses (e.g., general administrative and research and development costs).

Prepaid expenses, such as employee wages or subcontractor fees paid out or promised, are not recognized as expenses; they are considered assets because they will provide probable future benefits. As a prepaid expense is used, an adjusting entry is made to update the value of the asset. In the case of prepaid rent, for instance, the cost of rent for the period would be deducted from the Prepaid Rent account.